From the farmhouse to the statehouse, I'm always looking for ways to increase efficiency and eliminate waste.

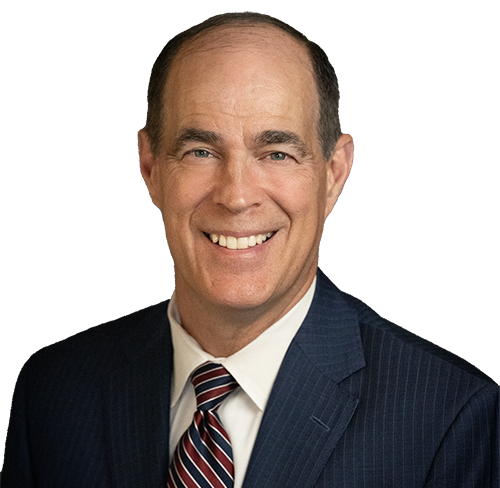

- Kansas State Treasurer, Steven Johnson

- Kansas State Treasurer, Steven Johnson